Uniswap Monthly Financial Report & Analysis - Jan 23

This Newsletter issue covers Uniswap DAO & Protocol Performance during Jan 23.

Table Of Contents

Governance Analysis

The Uniswap community voted on 2 major topics during January on Snapshot :

Uniswap v3 deployment on BNB Chain and the bridge choice for the governance messaging with the Alt-Chain, Wormhole got selected. This topic still has to go through On Chain governance for final implementation.

Uniswap Optimism OP Incentives phase 2 : The community decided to add DefiEdge as the 4th manager in addition to xToken, Gamma and Arrakis. The community also decided to replace ETH-USDC 5bps incentivised pool by wsETH-ETH 5bps pool, in addition to USDC-DAI 1bp and WETH-DAI 30bps.

No On chain governance decisions were executed during January.

Crypto Markets & UNI Analysis

It was a good start of the year for crypto markets, BTC gained 40% during January closing the month at 23k USD, recouping all Q4 losses. ETH closed the month at 1580 USD with a 32% monthly gain, underperforming BTC.

UNI closed the month at 6.56 USD with a 27% monthly gain. It seems that BTC is leading the recovery.

So, how did Uniswap perform during this green month ?

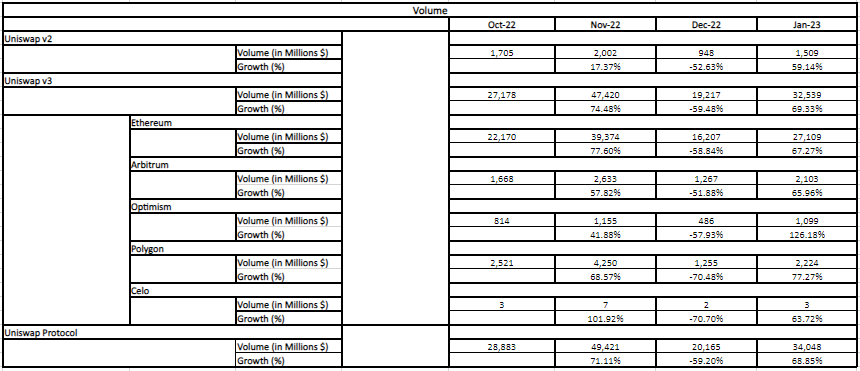

Volume Analysis

Data Source : Uniswap Extractor, FlipsideCrypto

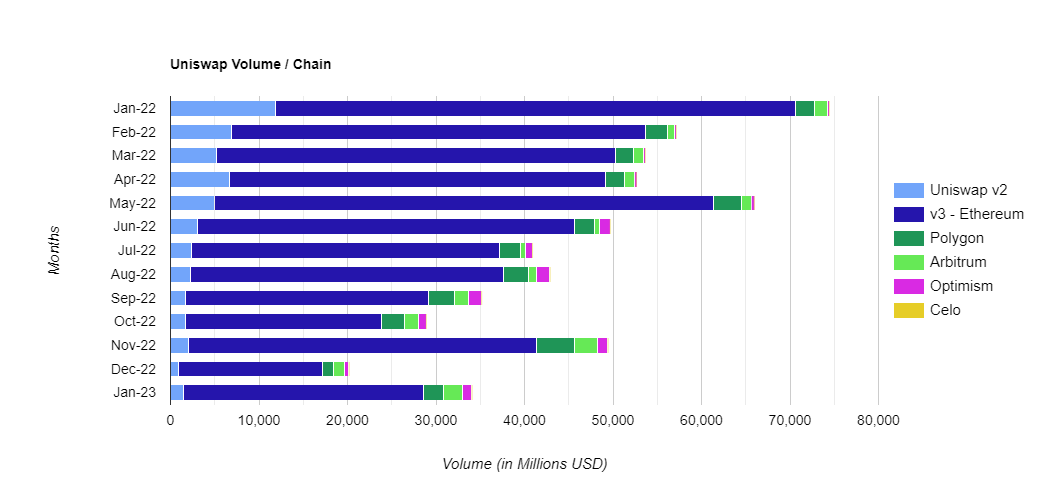

Uniswap protocol facilitated 34B USD in trading volume across all deployments during January, a 70% increase MoM.

27B USD came from Uniswap v3 Ethereum, representing 80% of the protocol’s total trading volume.

Optimism had a 126% increase in trading Volume MoM and Arbitrum is catching up with Polygon.

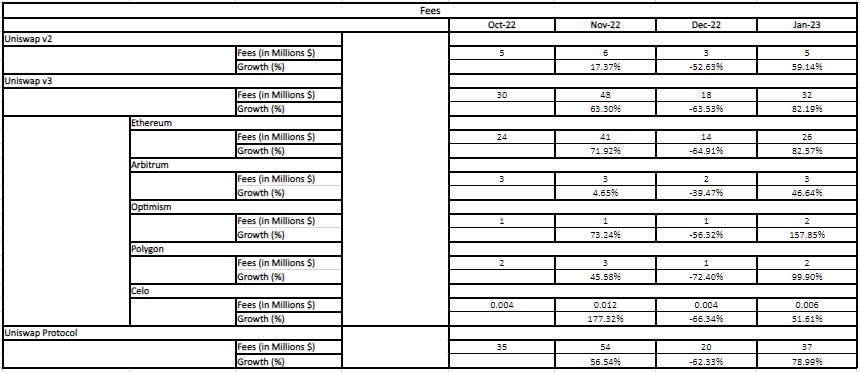

Fees Analysis

Data Source : Uniswap Extractor, FlipsideCrypto

Uniswap Liquidity Providers (LPs) made 37m during January. That’s 12.3% APR on the 3.6B Liquidity Supplied.

Uniswap v3 - Ethereum contributed 70% of fees to LPs.

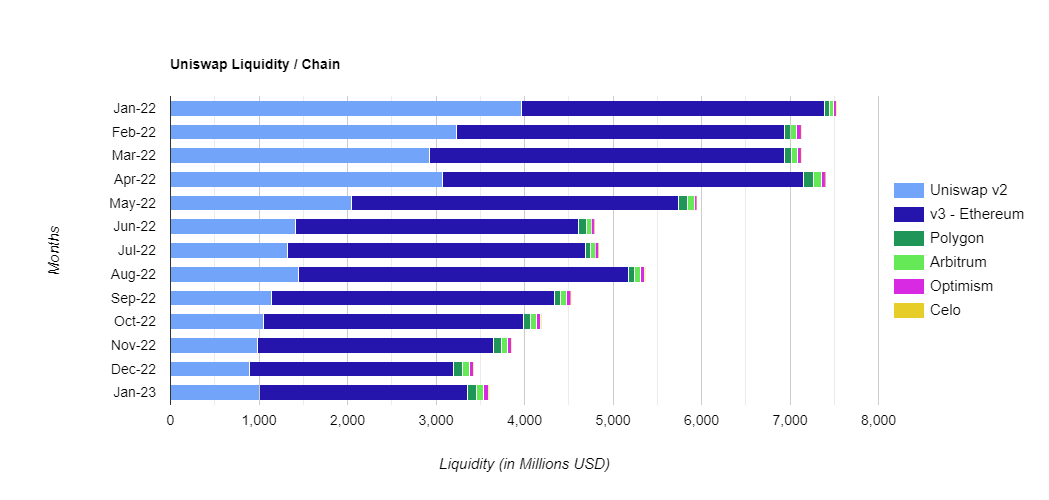

Liquidity Analysis

Data Source : DefiLlama

Liquidity is computed as the average of daily liquidity during the month.

Uniswap protocol had 3.6B in liquidity during January, a small increase of 5%. It seems that liquidity growth on Uniswap underperformed the crypto markets benchmarks (BTC & ETH).

Uniswap v3 - Ethereum had a small growth in liquidity of 2% during the month, dragging down the total score for the protocol.

Treasury Analysis

Data Source : Dune Analytics

UNI Holders own a massive 2.7B USD in Treasury, just to get how big that is : Uniswap can buy Aave (1.2B), Maker (600m) and Compound (400m) Circulating Supply (According to CoinGecko data), and still have half a billion in runway.

Volume / Chain

Data Source : FlipsideCrypto

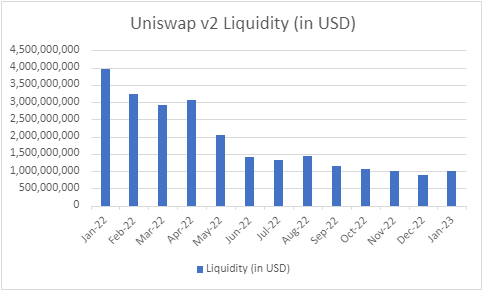

Uniswap v2 are still low compared to historical levels.

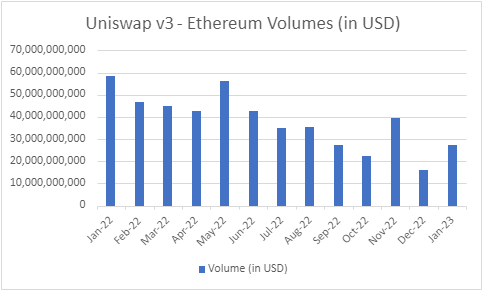

Data Source : Uniswap Extractor

v3-Ethereum had a monthly increase in volumes but performed poorly compared to BTC and ETH especially that this chain’s deployment is a hub for these two assets trading.

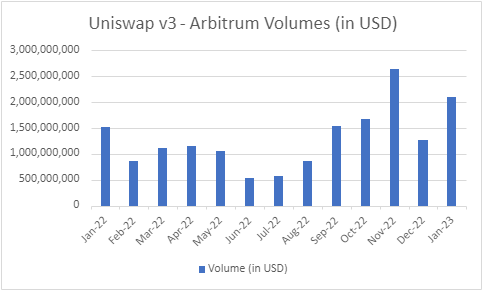

Data Source : Uniswap Extractor

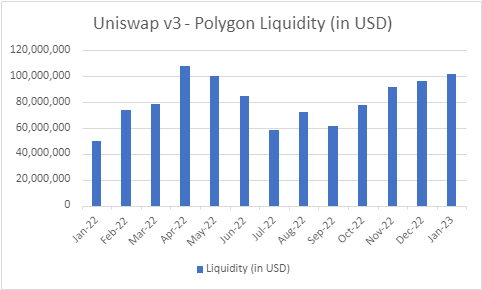

v3-Polygon Volumes for January were around the historical mean level of 2B.

Data Source : Uniswap Extractor

v3-Arbitrum had a nice performance during January with 2B USD facilitated by the protocol.

Data Source : Uniswap Extractor

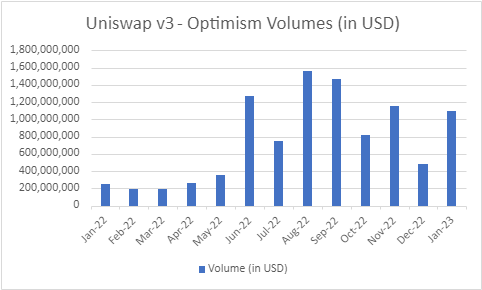

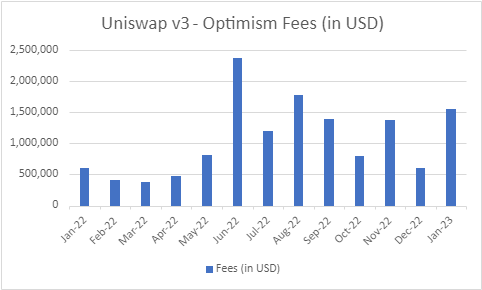

Optimism recorded trading volumes similar to November levels during January, but still lower than OP Summer.

Data Source : Uniswap Extractor

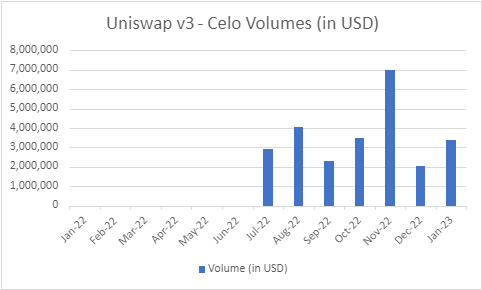

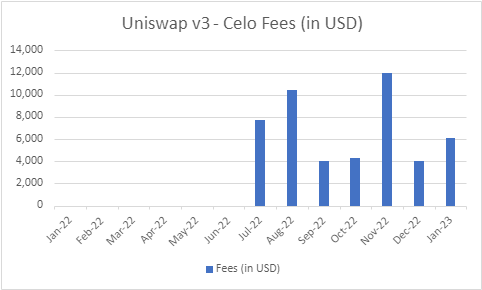

v3-Celo, the young Uniswap is facilitated around 3m USD in trading volume during January.

Data Source : Uniswap Extractor, FlipsideCrypto

Uniswap Protocol as a whole hasn’t broken the downtrend in trading volume of 2022 yet.

Fees / Chain

Data Source : FlipsideCrypto

Traders paid 30bps swap fee to execute their transactions on Uniswap v2, a fixed fee tier for this protocol deployment.

Data Source : Uniswap Extractor

Trades executed through v3-Ethereum cost 9.6bps during January on average.

Data Source : Uniswap Extractor

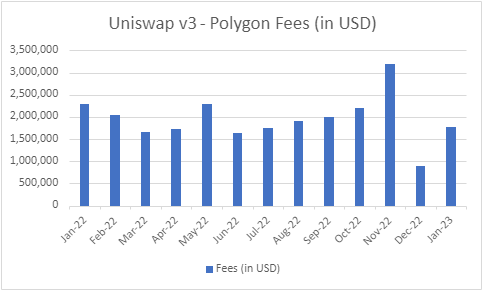

Swappers on Polygon paid on average 7.9bps fee to execute their transactions on Uniswap during January.

Data Source : Uniswap Extractor

v3-Arbitrum had higher fees of 13bps during January, more rewarding to LPs on average.

Data Source : Uniswap Extractor

v3-Optimism had an average swap fee of 14bps, similar to Arbitrum during January.

Data Source : Uniswap Extractor

v3-Celo had an average swap fee during January of 18bps.

Data Source : Uniswap Extractor, FlipsideCrypto

Swappers paid on average 10.8bps to execute their transactions on Uniswap protocol during January. LPs made 1.08 USD per 1k USD volume traded.

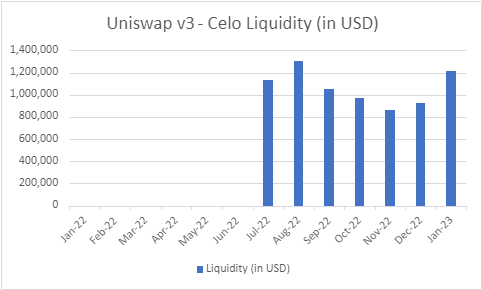

Liquidity / Chain

Data Source : DefiLlama

Based on January Fees, Uniswap v2 LPs made an annualized APR of 5% on liquidity supplied.

Data Source : DefiLlama

v3-Ethereum LPs made an annualized APR of 13% based on January Fees.

Data Source : DefiLlama

v3-Polygon LPs made 21% annualized return on liquidity supplied based on January fees.

Data Source : DefiLlama

v3-Arbitrum LPs made an impressive 38% annualized return on liquidity supplied based on January fees.

Data Source : DefiLlama

v3-Optimism LPs also made an impressive 36% annualized return on liquidity supplied based on Janauary fees.

Data Source : DefiLlama

v3-Celo LPs made 6% annualized return.

Data Source : DefiLlama

On Average, Uniswap LPs made 12% annualized return on liquidity supplied.

Supplying liquidity on Arbitrum & Optimism was more rewarding to LPs during January.

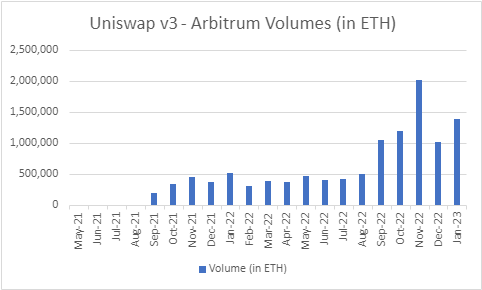

Focus 1 : Uniswap v3 Volumes in ETH

Data Source : Uniswap Extractor

Although Uniswap v3 Ethereum volumes in USD terms were downtrending since summer 2022, volumes in ETH during the same period were at higher levels than those recorded during 2021.

Data Source : Uniswap Extractor

v3-Polygon volumes in ETH have been overall trending higher since the protocol’s deployment on the chain.

Data Source : Uniswap Extractor

Volumes in ETH on v3-Arbitrum have been trending higher as well.

Data Source : Uniswap Extractor

Volumes on v3-Optimism have been relatively stable after the spike post OP token launch.

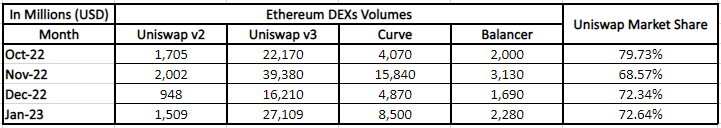

Focus 2 : Uniswap vs The Competition

Data Source : Defi Llama

Uniswap Competitors on Ethereum are mainly Curve and Balancer.

Uniswap dominates the Ethereum DEX industry with more than 70% trading volume market share.

Data Source : Defi Llama

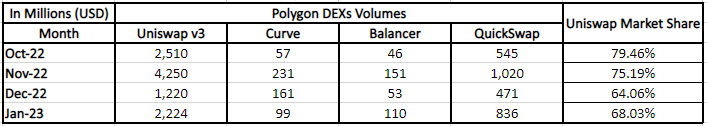

Uniswap’s competitors on Polygon are Curve, Balancer and a v2 fork, QuickSwap.

Uniswap dominates Polygon DEX industry with around 70% market share as well.

Data Source : Defi Llama

Arbitrum’s competition is similar to Ethereum. Uniswap is king of Arbitrum DEXs with more than 80% Market Share.

Data Source : Defi Llama

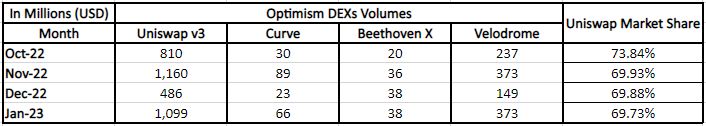

On Optimism, Uniswap competes with Curve, Velodrome a fork of Solidly (Curve in Solidity) and Beethoven X, a partner and fork of Balancer.

Uniswap dominates the DEX industry in Optimism as well with around 70% trading volume market share.